- HOME

- Sustainability

- Measures for Climate Change (TCFD)

Measures for Climate Change (TCFD)

Introduction (Approach to Addressing Climate Change)

The SCB has formulated the "Shinkin Central Bank Group SDGs Declaration" and, as the central financial institution of all shinkin banks, is working towards the realization of a sustainable society together with shinkin banks across the country, focusing on the three important pillars of "community," "people," and "environment," in accordance with the mutual aid and non-profit principles of a cooperative organization.

With regard to environmental issues, including climate change, the SCB has formulated the “The SCB Group Environmental Policy” and is actively working to resolve these issues through its operations and other activities.

In addition, in July 2019, the SCB endorsed the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) and is disclosing the following information in line with TCFD recommendations.

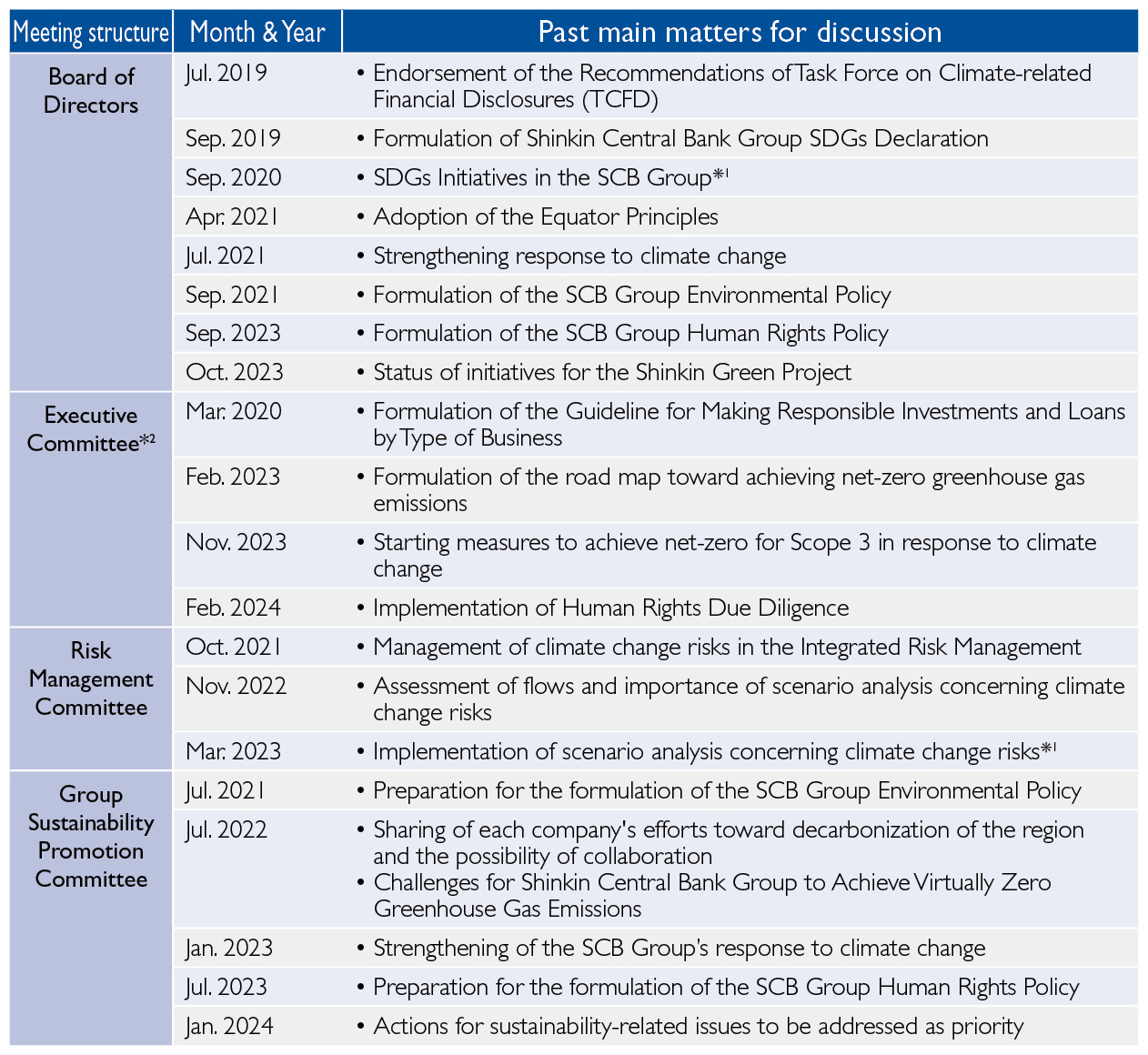

Governance

-

Policies regarding sustainability, including climate change, are discussed at the Executive Committee and then resolved at the Board of Directors. The progress of initiatives based on the policies of the Board of Directors is discussed at Executive Committee and reported at the Board of Directors at least once a year. We regularly discuss climate change risks at committees such as the Risk Management Committee, a subordinate body of the Management Committee, and other committees.

In addition, from the standpoint of integrated management as one banking group, we hold the “Group Sustainability Promotion Committee” meetings twice a year, a committee comprised of executive officers of the SCB and SCB Group companies to discuss such matters as the SCB Group’s policies and initiatives regarding sustainability including climate change.

※1This is a matter that is regularly discussed, so only the first meeting is listed.

※2Matters that have been submitted at the Board Directors after being discussed at the Executive Committee have been omitted.

- Initiatives for sustainability, including climate change, are being taken cross-organizationally, with the Sustainability Promotion Division playing a central role.

Strategy

Opportunities Associated with Climate Change

To realize a sustainable society, we set the “Shinkin Green Project” in the Medium-Term Management Plan and are actively working on measures such as promoting ESG investments and loans and decarbonizing regions. By leading these initiatives to the growth of the shinkin bank community, we aim to create a virtuous cycle for solving social issues further.

- We view the spread of renewable energy and the advancement of technological innovation as investment opportunities, and are promoting ESG investment and financing with a medium- to long-term goal of achieving a cumulative total of ¥3 trillion (from fiscal 2021 to fiscal 2030) toward 2030, the target date for the SDGs. We are also actively addressing transition finance for the transition to a decarbonized society. As a designated financial institution that conducts business adaptation promotion operations under the Industrial Competitiveness Enhancement Act, we will support the efforts of business operators to achieve carbon neutrality.

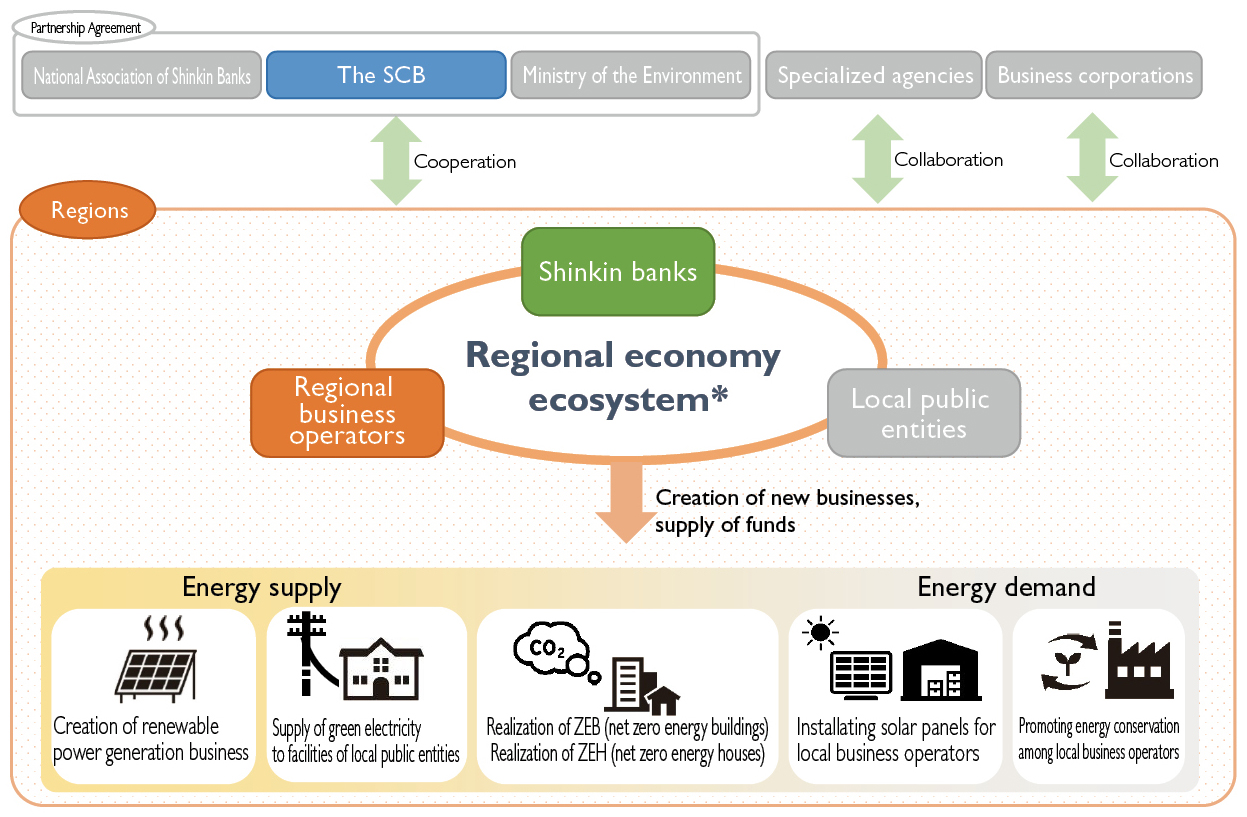

- We recognize that encouraging decarbonization efforts in regions and SMEs will not only lead to new businesses and growth opportunities for SMEs, but is also important from the perspective of revitalizing regional economies. Together with shinkin banks nationwide, the Green Project Promotion Office in the Sustainability Promotion Division, is taking the lead in promoting initiatives such as regional decarbonization in cooperation with government agencies and external organizations.

※A relationship in which each entity, including companies, financial institutions, local governments, and government agencies, plays its own role while building mutually complementary relationships and maintaining close ties with economic entities outside the region, cooperating and co-creating in a multifaceted way.

Risks Associated with Climate Changes

We recognize that potential climate change risks include risks associated with the transition to a low-carbon society, such as stronger climate-related regulations and technological innovation (transition risks), and risks associated with physical damage caused by natural disasters and increased abnormal weather due to climate change (physical risks). As these risks are expected to have a direct impact on our business activities and an indirect impact through the effects on our investment and lending destinations, we are establishing a business continuity system and assessing the impact on Shinkin Central Bank's finances.

- As the central bank for all shinkin banks, our business continuity plan (BCP) recognizes that in continuing to provide financial functions required to maintain the economic activities of shinkin banks as well as stakeholders, storm and flood damage and other disasters are events that have a material impact on performing businesses. We have established a structure that enables us to continue essential businesses when these become apparent.

-

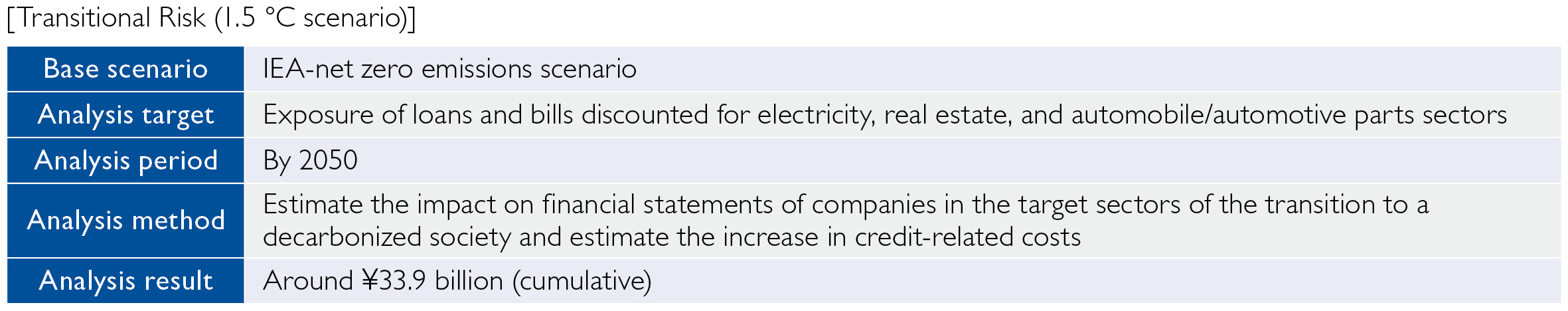

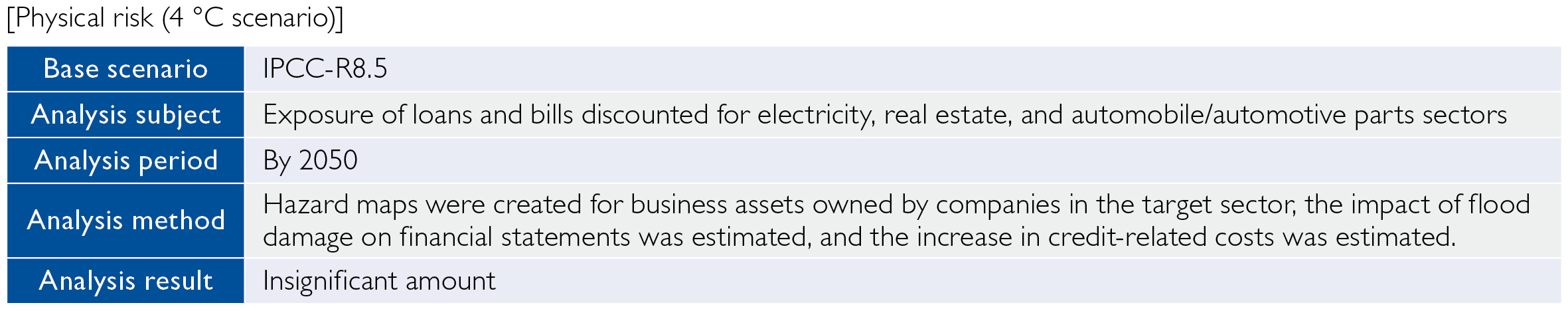

In order to quantitatively evaluate the impact on Shinkin Central Bank's finances of the impact of climate change on investment and lending recipients, we conducted the following scenario analysis.

Scenario Analysis for Climate Change

Based on the “Practical Guide for Scenario Analysis of Climate Change Risks and Opportunities in Accordance with TCFD Recommendations (for the Banking Sector) ver.2.0” released by the Ministry of the Environment, we analyzed two scenarios: “1.5 °C” and “4 °C.” Additionally, the exposures covered by the analysis were limited to loans, in line with the TCFD recommendations.

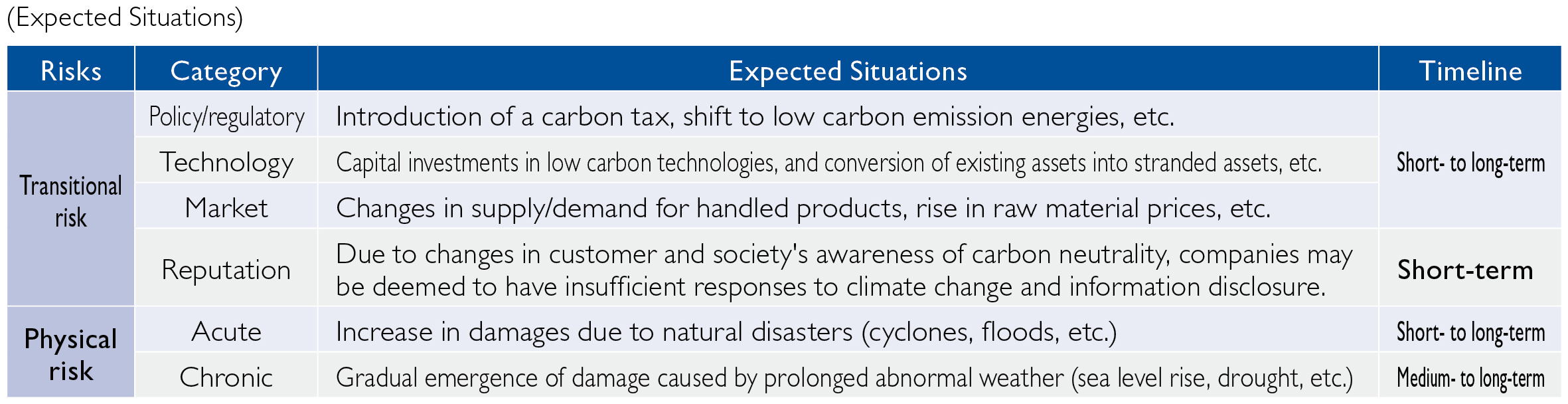

①Organization of worldview per scenario

The worldviews of the 1.5°C and 4°C scenarios are as follows. In understanding the risks of each scenario, short-term, mediumterm, and long-term timescales are set as the time spans to be addressed.

[Worldview of the 1.5℃ scenario]

Towards achieving net zero by 2050, strict measures have been taken in "policy-based legal regulations," and awareness is changing throughout society.

- (Expected Impacts)

- The risks associated with the transition to a low-carbon society (transitional risk), such as tighter climate-related regulations and technological innovation, will increase and affect the businesses and financial conditions of investment and loan customers, which can be expected to affect a portfolio indirectly. At the same time, physical risks are assumed to be lower than those in the 4 °C scenario.

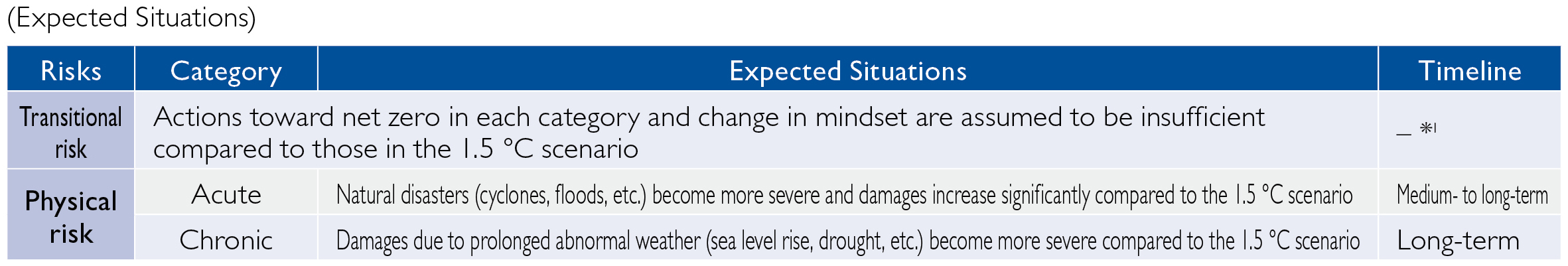

[The worldview in the 4 °C scenario]

No major changes in the mindset of the entire society as actions under “laws and regulations based on policy” toward net zero by 2050 are insufficient, and disasters become more severe

※1This is indicated as "-" because it assumes a situation in which climate change responses are not adequately implemented.

- (Expected Impacts)

- The risk of physical damage caused by natural disasters and abnormal weather due to climate change is expected to increase, and this risk could have an indirect impact on the portfolio through an impact on the business and finances of the borrowers to which we invest. At the same time, transitional risks are assumed to be lower than in the 1.5 °C scenario.

②Selection of important sectors

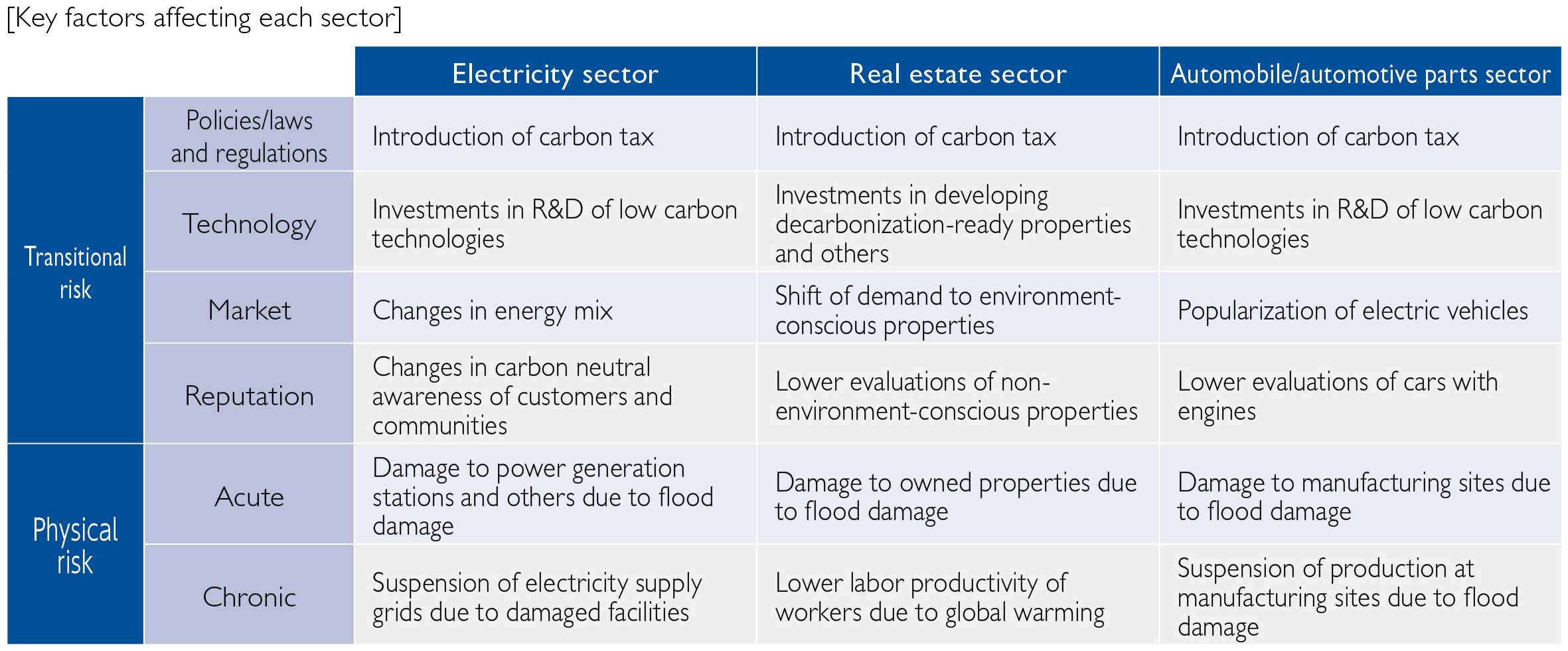

Given the degree of climate change impacts and the scale of exposure of loans and bills discounted, we selected the electricity, real estate, and automobile/automotive parts sectors as important sectors for scenario analysis.

③Organization of transmission channels for impacts on financial conditions of important sectors

We identified the transmission channels in which climate change impacts companies’ financial conditions in the important sectors in “the 1.5 °C scenario” and “the 4 °C scenario.” In this process, we recognized important elements as listed in the table below.

④Quantitative assessment of transitional and physical risks in important sectors

In line with the transmission channels, we estimated each company’s financial statements by 2050. We calculated the increase in credit-related costs appropriate to the corporate credit strength changes derived from the resulting estimation.

⑤Scenario analysis results

For key sectors, the transition risks amount to a cumulative total of approximately 33.9 billion yen by 2050, while the physical risks are estimated to be an insignificant amount, meaning that the financial impact of either is likely to be limited.

-

As of March 31, 2024, carbon-related assets accounted for 28.8% of total loans※2. Based on TCFD recommendations, loans to the energy, transportation, materials and construction, and agriculture, food, and forest products groups are defined as carbon-related assets.

※2Total direct lending to members (shinkin banks) and non-members (¥8,648.9 billion)

Risk Management

- We manage climate change risks in the integrated risk management framework. Specifically, we recognize that these risks are causes of generating or amplifying risks in risk categories (such as market and credit risks). We add climate change events to a risk map that classifies and organizes them according to two criteria: “impact on the SCB” and “probability of occurrence,” and visualize and share them. The risk map is reviewed, and revisions are approved as needed in the regular Risk Management Committee, which comprises executive officers and heads of related departments. We respond to risk events according to their impact and likelihood.

-

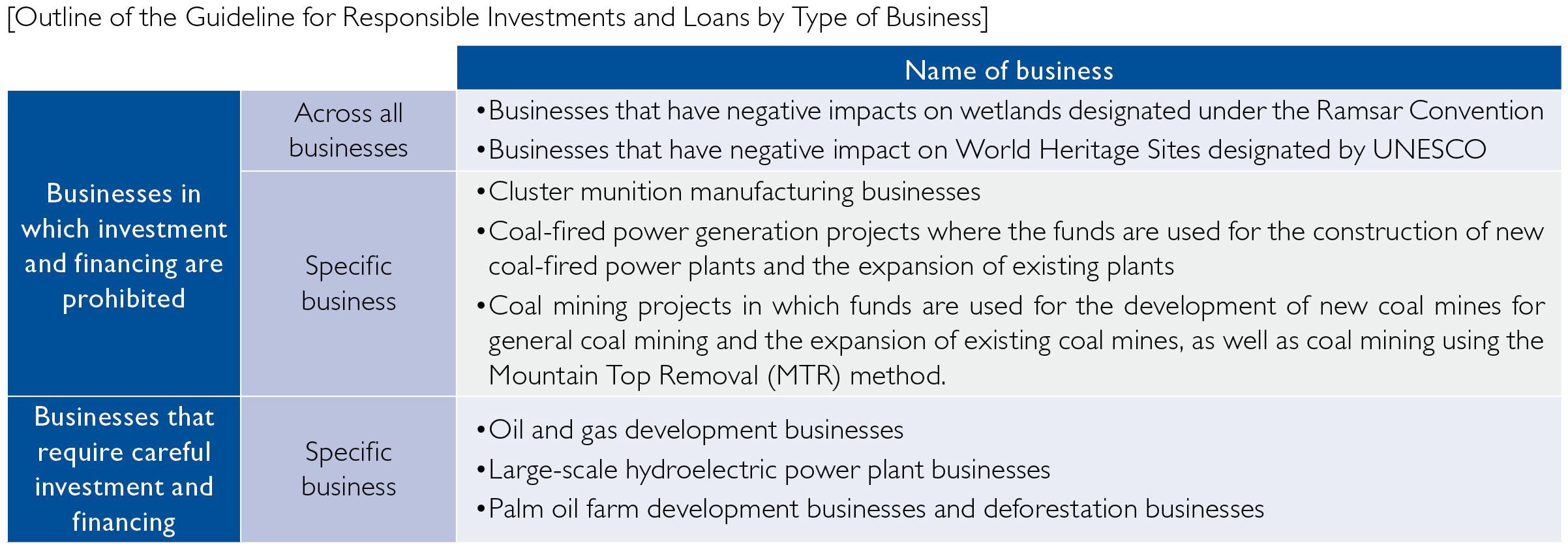

We have distinguished those sectors whose financial conditions are susceptible to climate change and formulated the “Guideline for Responsible Investments and Loans by Type of Business.” By making investments and loans in accordance with this Guideline, which is continually being revised, we contribute to the realization of a sustainable society as well as manage the financial impact on the SCB. In April 2024, we set forth a policy on investments and loans applicable across all businesses.

- We adopted the Equator Principles in April 2021. Based on them, we have established an internal management system and evaluate the environmental and social impacts of projects in the decision-making process for project finance, etc., and continuously monitor those developments even after the project begins operation.

- In the framework of credit screening, the impact of ESG factors on the creditworthiness of the customer is qualitatively evaluated, and credit decisions are also made based on the evaluation results. In addition, when investing in funds, we evaluate the ESG investment stance of the entrusted asset management company and make investment decisions based on the evaluation results.

Metrics and Targets

-

We have set a target of ¥3 trillion for the cumulative amount of ESG investments and loans from fiscal 2021 to fiscal 2030. The scope of ESG investments and loans is defined as investments and loans that contribute to solving environmental and social issues (bonds, loans, funds, project finance, PFI, etc.) with reference to international principles and government guidelines.

![[ESG Investment and Financing Execution Amount] Target: Cumulative execution amount of 3 trillion yen from fiscal year 2021 to fiscal year 2030 Achievement: Cumulative execution amount of 1.3386 trillion yen from fiscal year 2021 to fiscal year 2023 (of which 268.5 billion yen in the environmental field)](/e/sustainability/img/climate_img_09.jpg)

-

We have set targets for reducing the balance of investments and loans used to finance the construction of coal-fired power plants by 50% by fiscal 2030 from the end of fiscal 2020 and to zero by fiscal 2040.

![[Outstanding Balance of Investment and Financing for Coal-Fired Power Plant Construction] Target: 50% reduction from the end of fiscal year 2020*1 by fiscal year 2030, and zero by fiscal year 2040 Achievement: Balance at the end of fiscal year 2023: 5.9 billion yen *1 Balance at the end of fiscal year 2020: 5.9 billion yen](/e/sustainability/img/climate_img_10.jpg)

-

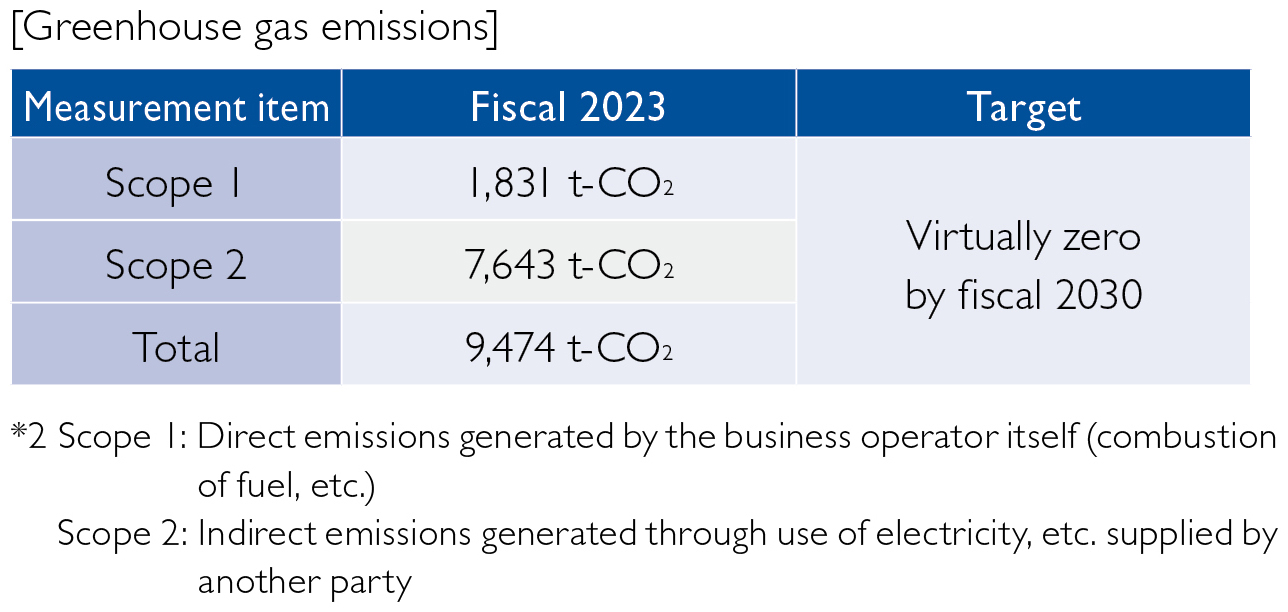

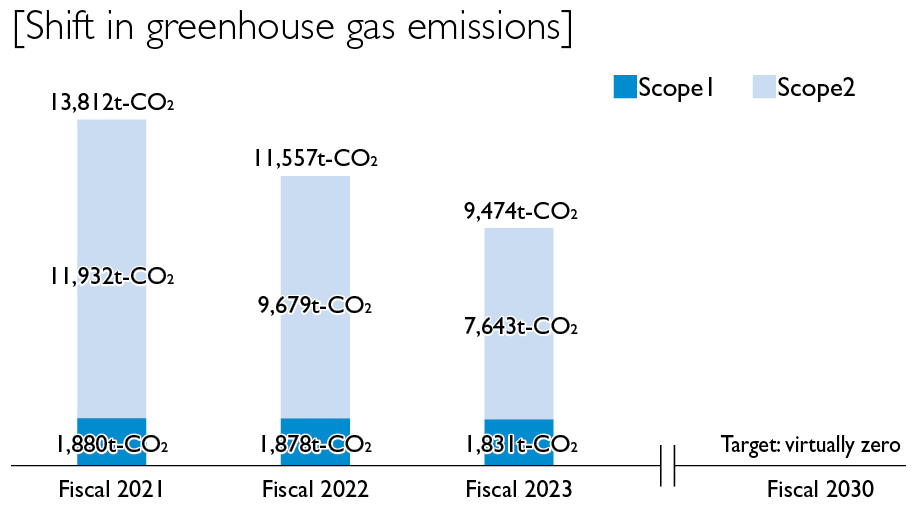

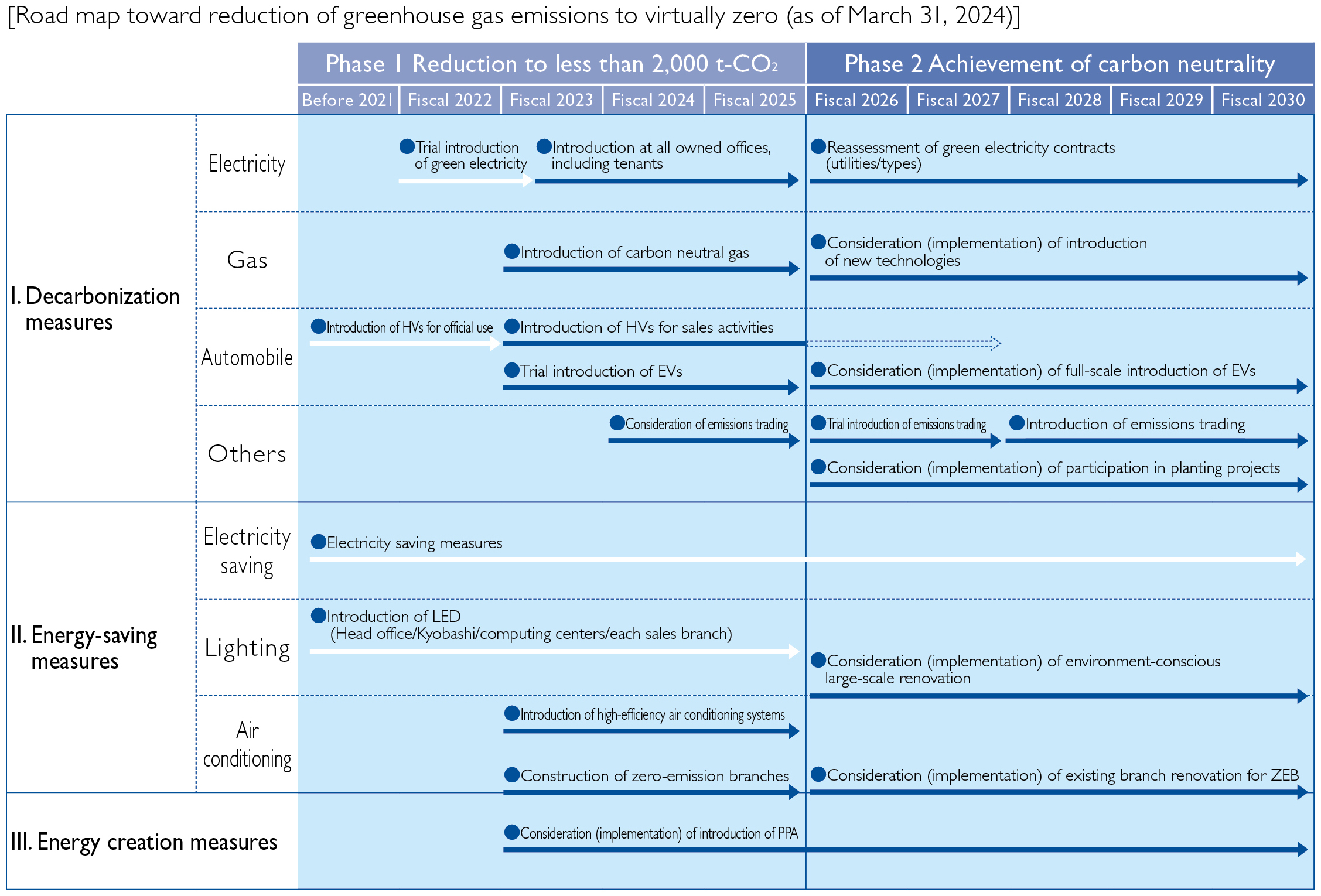

To contribute to “carbon neutrality by 2050,” as outlined in the Paris Agreement and by the Japanese Government, the SCB has set a target to reduce greenhouse gas emissions (Scope 1 and Scope 2)※2 to virtually zero by fiscal 2030. Based on the road map for the target, we divided our initiatives toward carbon neutrality into two phases: Phase 1, which is up to fiscal 2025, and Phase 2, which begins from fiscal 2026. We set staged targets for each phase and are implementing various measures around the three pillars including “decarbonization,” “energy-saving,” and “energy creation.”

In Phase 1, our target is to reduce greenhouse gas emissions to 2,000 t-CO2 or less by fiscal 2025. In fiscal 2023, we implemented decarbonization measures such as switching to electricity generated from renewable energy and introducing hybrid and electric vehicles.

In addition, to further expand measures for fiscal 2024 and beyond, we are implementing new initiatives such as considering the introduction of carbon neutral gas and undergoing energy-saving diagnosis by an third-party organization.

-

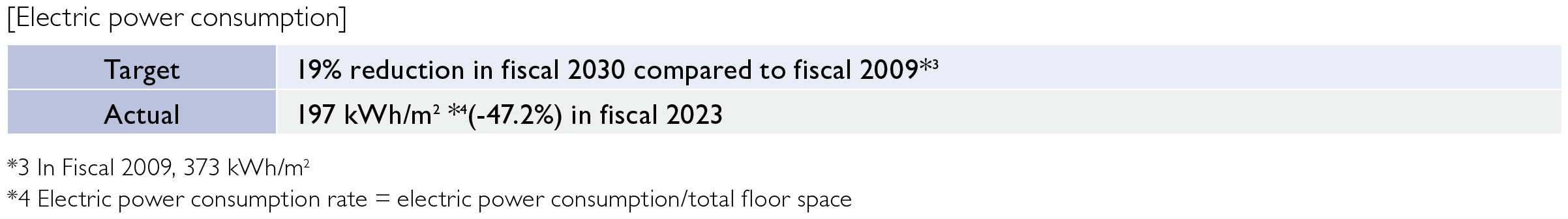

In order to reduce CO2 emissions, we are taking actions to reduce electricity consumption to meet the targets under the “shinkin bank community’s environmental voluntary action plan.”

Initiatives Toward Natural Capital and Biodiversity

Recently, around the globe, there has been heightening momentum toward Nature Positive initiatives to halt and reverse loss of natural capital and biodiversity.

In the SCB Group Environmental Policy, the SCB commits to addressing endangered biodiversity and other environmental issues through its business operations. Specifically, as an institutional investor, we have formulated the “Guideline for Making Responsible Investments and Loans by Type of Business” to manage our financial impacts while giving due consideration to the environment. We have also adopted the Equator Principles to assess environmental and social impacts on project finance, etc.

We are building the necessary structure while driving a better understanding of these issues at management level by, for example, conducting training for officers on themes of natural capital and biodiversity issues.

Going forward, in order to further strengthen our nature-positive efforts, we will improve disclosures on risks, dependencies, and impacts of natural capital and biodiversity based on the TNFD (Task Force on Nature-related Financial Disclosures).