- HOME

- Sustainability

- Implementation of the Equator Principles

Implementation of the Equator Principles

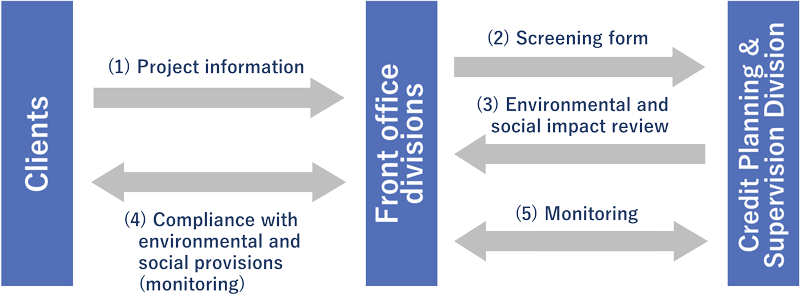

- In adopting the Equator Principles, the SCB established the “Procedures for the Equator Principles” that states the process of conducting the environmental and social impact assessment. The Credit Planning & Supervision Division conducts the environmental and social impact assessment based on project information provided by the clients of our front-office divisions.

- To deepen understanding of the concepts behind the Equator Principles and our process of conducting the environmental and social impact assessment, the Credit Planning & Supervision Division created training tools and our staffs can access them at all times. The SCB will make continuing efforts to raise awareness of environmental and social considerations through the internal training programs.

Implementation framework and processes

Applicable transaction and Scope of the Equator Principles

| Financial instruments and services | Applicable scope |

|---|---|

| Project Finance | Total project capital costs of USD 10 million or more. |

| Project Finance Advisory | |

| Project-Related Corporate Loans |

Corporate loans where all of the following three criteria are met: 1. The majority of the loan is related to a Project over which the client has Effective Operational Control (either direct or indirect). 2. The total aggregate loan amount and the Equator Principles Financial Institution's individual commitment (before syndication or sell down) are each at least USD 50 million. 3. The loan tenor is at least two years. |

| Bridge Loans | A tenor of less than two years that are intended to be refinanced by Project Finance or a Project-Related Corporate Loan that is anticipated to meet the relevant criteria described above. |

| Project-Related Refinance and Project-Related Acquisition Finance |

Finance where all of the following three criteria are met: 1. The underlying Project was financed in accordance with the Equator Principles framework. 2. There has been no material change in the scale or scope of the Project. 3. Project Completion has not yet occurred at the time of the signing of the facility or loan agreement. |

Environmental and social risk assessment and monitoring

Based on each Equator Principles, we assign categories to applicable projects and conduct monitoring according to the categories.

| Principles | Applicable requirements |

|---|---|

| Principle 1 | Review and Categorization |

| Principle 2 | Conduct an appropriate environmental and social assessment |

| Principle 3 | Comply with applicable environmental and social standards |

| Principle 4 |

Develop or maintain an environmental and social management system Prepare an environmental and social management plan and, where necessary, develop Equator Principles action plan |

| Principle 5 | Demonstrate effective stakeholder engagement |

| Principle 6 | Establish effective grievance mechanisms |

| Principle 7 | Carry out an independent review of the assessment process and documentations by independent environmental and social consultant |

| Principle 8 | Incorporate covenants linked to compliance with the Equator Principles |

| Principle 9 | Monitor and report by independent environmental and social consultants |

| Principle 10 | Report and ensure transparency |

| Category | Description |

|---|---|

| A | Projects with potential significant adverse environmental and social risks and/or impacts that are diverse, irreversible or unprecedented |

| B | Projects with potential limited adverse environmental and social risks and/or impacts that are few in number, generally site-specific, largely reversible and readily addressed through mitigation measures |

| C | Projects with minimal or no adverse environmental and social risks and/or impacts |

Transactions in accordance with the Equator Principles

1. Project Finance(the number of transactions that reached financial close in CY2023 (from January 1, 2023 to December 31, 2023).

| Category A | Category B | Category C | |

| ― | 4 | ― | |

| Sector | CategoryA | CategoryB | CategoryC |

| Mining | ― | ― | ― |

| Infrastructure | ― | ― | ― |

| Oil & Gas | ― | ― | ― |

| Power | ― | 3 | ― |

| Others | ― | 1 | ― |

| Region | Category A | Category B | Category C |

| Americas | ― | ― | ― |

| Europe, Middle East & Africa | ― | ― | ― |

| Asia Pacific | ― | 4 | ― |

| Country Designation | Category A | Category B | Category C |

| Designated Country | ― | 4 | ― |

| Non-Designated Country | ― | ― | ― |

| Independent Review | Category A | Category B | Category C |

| Yes | ― | 4 | ― |

| No | ― | ― | ― |

2. Project Finance Advisory Services(the number of transactions in which the SCB played an FA services role in CY2023 (from January 1, 2023 to December 31, 2023).

| Sector | Total |

|---|---|

| Mining | ― |

| Infrastructure | ― |

| Oil & Gas | ― |

| Power | ― |

| Others | 4 |

| Region | Total |

| Americas | ― |

| Europe, Middle East & Africa | ― |

| Asia Pacific | 4 |

3. Project-Related Corporate Loans

Total number of transactions that reached financial close in CY2023 : Not Applicable

4. Bridge Loans

Total number of transactions that reached financial close in CY2023 : Not Applicable

5. Project-Related Refinance and Project-Related Acquisition Finance

Total number of transactions that reached financial close in CY2023 : Not Applicable